What if you can’t retire on time? What if you must keep working into your late 60s, 70s? Without a written retirement strategy you risk both of these. It doesn’t matter how much money you make. A simple retirement preparation checklist can help you set your goals and reach your dreams.

And with the help of retirement budget spreadsheets and investment calculators you can calculate specific numbers, track and analyze them to ensure that you don’t have to RETIRE TWICE!

Work because you want to work NOT because you have to.

But what vital retirement factors should you include into your retirement plan? What if you miss something important like the future dollar value, taxes or major life changes?

And while I am not a financial adviser you’ll soon see how detailed my list is with points you may not have previously considered to input into your retirement strategy.

At the end I recommend a simple, inexpensive retirement investment calculator and spreadsheet. They do NOT require expensive monthly membership payments NOR will they overwhelm or confuse you with too many details or information.

This retirement goal spreadsheet works on any device and you can customize it like I did to fit your own personal needs.

Let’s base this list on one assumption.

You retire at the full-retirement age between 65 and 67 for eligibility to collect full Social Security benefits (US residents only). In fact click here to calculate your full retirement age with this free retirement age calculator to find out when you will be fully eligible.

For all the calculations we will discuss start from your current age.

11 Point Retirement Preparation Checklist…that Will Allow You to Retire On-time and Only One Time (NOT TWICE)

1. Current Household Expense Budget vs Post-Retirement Household Budget

If you wish to retire on-time then you must track your expenses.

Here’s the starting point for your retirement preparation checklist.

Categorize your expenses between fixed (electric bill, insurances) and variable (gasoline, groceries). Your current budget will at least provide a close idea of how much to expect after retirement.

Items farther down on this list will help predict the life changes that affect your post-retirement household budget.

I found a simple household expense spreadsheet that allows you to track your spending and notifies you when you go over budget. It also automatically creates graphs and charts to analyze your finances in a more quick, visually appealing way.

Download the free sample family household expense budget spreadsheet here.

2. Combine All Retirement Income (SS, Pension, 401k, Traditional and Roth IRAs, Annuities, etc)

Without a retirement budget spreadsheet or other tracking system you could easily leave out one source of retirement income which would erroneously change all your calculations, including anticipating future taxes.

A spreadsheet or online tracking system keeps all your post-retirement sources in one spot for easy analysis.

3. Calculate Desired Post-Retirement Monthly Income Target

Calculating a lump sum amount for retirement won’t really help you choose the quality of life you want.

But you will need to determine a lump sum amount to shoot for upon retiring and begin to draw from your accounts, adjusted for decreasing balances and predicted rate of returns (unless the rate is set like in fixed annuities).

Your current household expense tracking system will guide you, but don’t forget to factor in inflation.

You will also include inflation to determine your real rate of return which is the annual percentage return on an investment including estimated factors that adjust the future value of your money.

Any retirement investment calculator should include an average 3-5% annual inflation rate.

You must determine how much money per month you will need to not only cover your daily expenses, but for the fun stuff too.

4. Plan Sufficient Monthly, Yearly Investment Savings Amount, Track and Analyze

Once you have a target income to aim for you will determine how much money to save each month to reach your goal for each retirement type account.

Without a retirement investment calculator you have no shot of figuring this number out.

And without an income and expense spreadsheet you won’t be able to track and analyze if you stay on target or not.

Tip: Overestimate these numbers to ensure you reach your goals- better safe than sorry.

5. Possible Major Life Changes

Hope for the best, plan for the worst.

Anticipate major life changes on your retirement preparation checklist that will affect future monthly household budget and savings.

- Marriage

- Children

- Divorce

- Career Change

- Caring for Elderly Parents

- Death of Spouse

Such events will also you to force to adjust for taxation, early retirement penalty withdrawal fees, 401K rollovers to IRAs (which change the investments within your portfolio thus changing the rates of return), legal fees, division of assets, loss of income, to mention a few.

6. Debt Management

Your financial boat won’t stay afloat with a hole in the hull.

While not sexy to talk about, debt management just may be the most important section of your retirement preparation checklist.

If you carry credit card or other miscellaneous loans then you need a plan to rid yourself of it. Add the payoff plan to your expense spreadsheet including interest payments.

Categorize your debt management section of your household expense spreadsheet by the different types debts including mortgage payments, school and car loans.

Try out this free debt elimination calculator to determine how fast you can get rid of your debt if you owe on multiple credit card balances.

7. Tax Management

Whether you own a business and plan to sell it at or before retirement, wish to plan ahead for paying taxes upon withdrawals from your retirement accounts, you need to include taxes on your retirement preparation checklist.

Hopefully you’ve done your research and chosen some tax-advantaged retirement accounts.

Add them into your retirement budget spreadsheet calculations.

Check out this article by financial planner Jonathan D. Pond which lays out some tips to reduce taxes on post-retirement account withdrawals or this equally as easy-to-read article by Kiplinger regarding planning your retirement tax strategy.

8. Income Management

You’ve set your sights on your ideal post-retirement lifestyle, done your calculations with the help of certified financial planner, know your target monthly savings amounts.

Then you find out you fall short of the required income to reach your goals.

Now what?

This section of your retirement preparation checklist involves deep thinking and reflection outside of just calculating numbers and analyzing investment spreadsheets.

One place to re-evaluate in #1 on this list- what monthly expenses or even one-time purchases on your household expense spreadsheets are less important to you than achieving your post-retirement lifestyle?

Can you get rid of them?

Can you brainstorm any ideas to obtain more lump sums of cash or reliable on-going income sources?

Random Income Producing Ideas

Both one-time amounts and on-going income sources

- Downsizing your home.

- Selling household items or collectables

- Reverse Mortgages

- Subletting rooms in your house

- Passive or semi-passive income sources (vending machines, real estate investments, monetized blogs, home purchase or sale referrals to real estate agents- you must have real estate license, etc. I could go on for a while here.

- Part-time or seasonal job

- Tutoring

- Online-income producing ventures- taking surveys, conducting research for websites, completing product reviews, document translation (if you speak another language fluently of course)

This list could easily be triple this size. I’ll create a future post for this section.

But read this article on Dave Ramsey’s site creative ways his readers told him they make extra money. (The article bases the extra income generation for the purpose of eliminating debt- which we cover in the father down on this list- but it still works for this section on my list here.)

Or if you seek investment-focused ideas to better diversify your retirement portfolio to create additional incomes then download this free T Rowe Price PDF for some creative adjusted retirement strategy ideas or read this Consumer Reports article I found which outlines 4 guaranteed-income-boosting investments to safeguard your retirement assets.

9. Post-Retirement Healthcare: Medicare and MediGap

It’s not all about fun and games when planning for retirement.

We all dream of buying yachts, international travel and beach cottage shopping, but lets remember to add addressing health issues to our retirement preparation checklist.

I won’t cover details for Medicare or MediGap in this post, but you can check out these two articles regarding coverage and costs associated with the programs.

Also download this PDF regarding Medicare qualification guidelines.

What’s not covered in Medicare?

Check out how MediGap supplements Medicare coverage. Check out this article by WebMd outlining Medigap details.

Or compare all everything from this section in this one spot Medicare and Medigap analysis tool at Medicarewallet.org.

10. Asset Allocation

You should not employ a one-size-fits all, cookie-cutter approach to asset allocation. To reach your post-retirement income targets proper asset allocation customized to your situations, needs and risk tolerance serve as the bridge you must cross to safely arrive to the other side of retirement.

Alpha Architect defines asset allocation as the process by which an investor or investment professional allocates percentages of a portfolio among various asset classes (e.g., stocks, bonds, real estate, commodities).

Read their article here which provides a simple breakdown of asset selection strategy and the three problems they see with traditional asset allocation strategies we rarely discussed by investors or advisers.

Or listen to Financially Blonde’s podcast on the differences between aggressive vs conservative investment portfolios.

11. Insurances

Add insurances on your retirement preparation checklist.

You may want to find a licensed professional financial planner. Find someone competent in the variety of insurances who will advise you, not sell you.

Also take the opportunity to research the benefits of the following insurances.

Value of Life Insurance

Premature death of a spouse equals loss of current and future income. That of course means lack of ability to pay bills and to invest into your retirement savings plan.

Read this article from Fidelity I found here regarding the

- Benefits of cost effective life insurance

- How much to purchase

- Which type suits you the best?

Unless I am missing something, term-life insurance is the way to go.

Take Suzy Orman’s quiz to determine how much term-life insurance you need.

Compare life insurance company consumer reviews by state here.

Long-term Care Insurance

The probability you will one day become frail and need taken care of is high.

Long-term care insurance pays for the highly skilled nursing service to care for you when you need it.

Before you brush off the desire to buy long-term care insurance read this comprehensive, easy-to-understand article from AARP.

And for some PROs and CONs of long-term care insurance check out this article.

Disability Insurance

If you became disabled during your income producing years then you may have to delay retirement or worse, not be able to.

Disability insurance often gets overlooked when selecting employer insurance benefits, but be careful not to make that mistake.

Even if your company automatically offers you disability insurance do you have enough? Before you skip to the next section of this post at least skim through this article. It explains some details of disability insurance.

Try out this disability insurance calculator.

It will help you determine how much coverage you would need to maintain the same lifestyle were you to become disabled and unable to work.

This way you at least choose the proper selection from your company’s benefits.

This is just a basic list touching on the purpose of insurances to keep you in-line with your retirement goals.

However, if you have a large asset portfolio and many financial responsibilities then only research for a basic understanding.

I’d highly recommend searching for and interviewing reputable financial planners.

Find someone who could help you design and routinely monitor your entire financial portfolio.

You’ve finished your retirement preparation checklist now what?

You will need a place to track your numbers.

Do you want a simple tool to help you with this- nothing overwhelming?

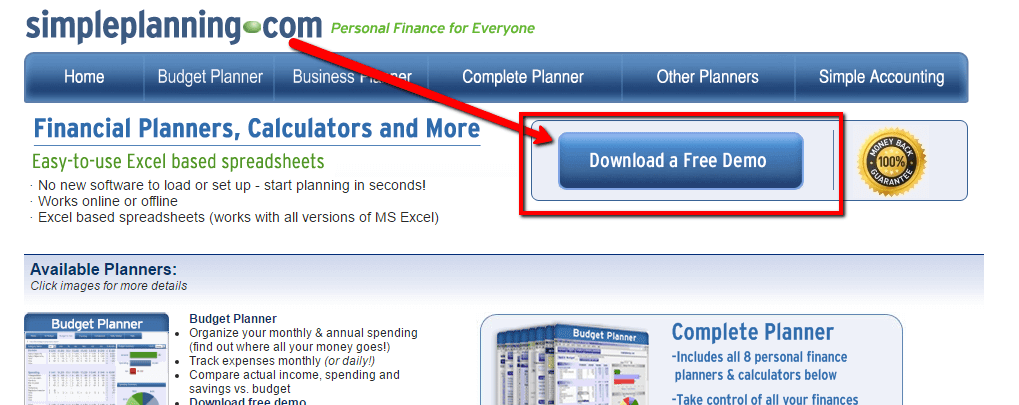

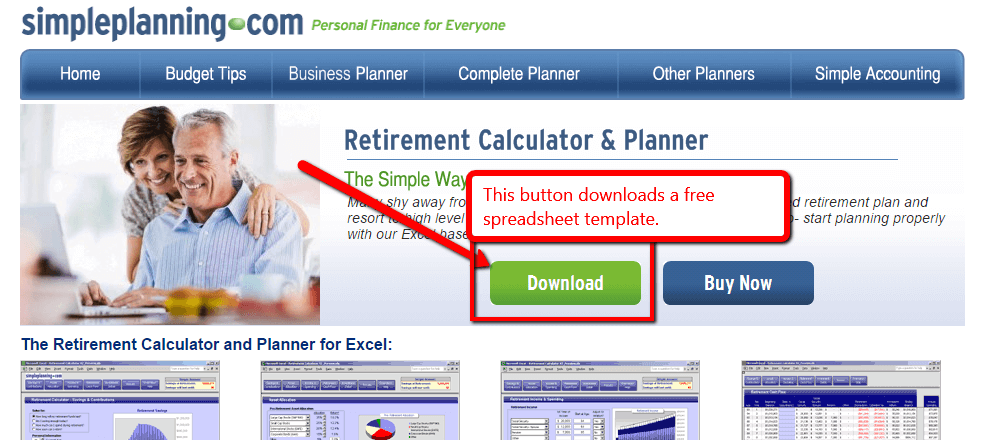

Try the household expense spreadsheet and the retirement investment calculator and planner from SimplePlanning.com.

Download a free trial sample template of either product.

For a one-time, inexpensive investment of $15.95 you can purchase your own copy of either one. Then customize them and continue to use them forever.

Download your free trial sample spreadsheets here.

And don’t forget to also download your free retirement preparation checklist I made for you here.